So many partner programs today look great on paper – neatly tiered, logically structured, and beautifully branded – but are completely misaligned with how partners actually do business. Vendors create elegant, structured frameworks, while partners build flexible, adaptive models that shift daily based on customer needs.

The result is that partners have evolved faster than the partner programs that were created to serve them.

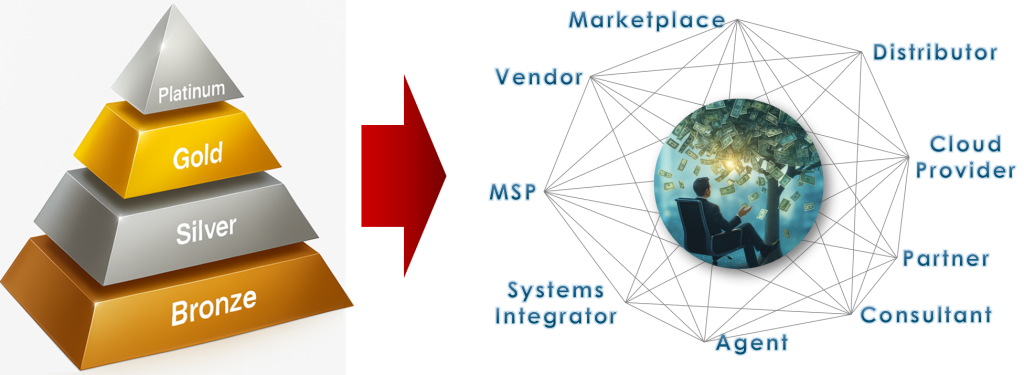

The Channel Has Outgrown the Pyramid

For decades, the channel resembled a tidy pyramid – a small number of top-tier partners generating the most revenue, a solid middle of mid-tier performers, and a broad base of transactional resellers at the bottom. The metrics to reward them were simple: certifications, sales volume, and revenue thresholds. The model worked well when products were tangible, sold in boxes, and success was measured in quarterly shipments.

But the world has changed.

Cloud, managed services, and subscription models have blurred the lines between vendor, distributor, partner, and customer. The most influential partners today might never close a transaction at all – they might design the architecture, manage the workload, or influence the buying decision behind the scenes.

What used to be a very linear model (vendor to distributor to reseller to end-user) now looks more like a spider web… a network of interdependent players creating value in different ways. Some sell, some service, some influence, some co-develop.

The old pyramid program model doesn’t capture that complexity.

Forcing different types of partners into the same set of tiers and rules is like forcing different types of cars to race against each other, but using the same lap time to decide the winner. (I’m going to revisit this analogy later)

From Rigid Programs to Adaptive Frameworks

The vendors that are getting this right aren’t just “modernising” their programs – they’re re-thinking what engagement means. Instead of asking “What tier should this partner be in?” they’re asking “How does this partner create value, and how can we reward that?”

We’re seeing the rise of adaptive programs – frameworks that let partners define their own path within the ecosystem – whether they sell, build, influence, or manage. Rather than forcing everyone into the same metrics, vendors are creating multiple paths to success. Points-based systems are replacing rigid tiers, rewarding a mix of activities such as customer wins, certifications, or usage growth. Others are experimenting with role-based enablement, tailoring training and incentives to whether the partner acts as a seller, builder, or influencer.

The vendors getting this right aren’t just modernising their programs – they’re rethinking what engagement means. Instead of asking “What tier should this partner be in?” they’re asking “How does this partner create value, and how can we reward that?”

This shift requires more than policy tweaks. It requires data, and a willingness to measure things that can’t always be captured in a spreadsheet. A partner who influences a $1 million deal but doesn’t transact it still creates enormous value. The challenge is finding ways to track that influence credibly and consistently.

Outcome-Based Incentives: Rewarding What Matters

For years, partner incentives revolved around activity – how many deals registered, how much revenue generated, how many certifications achieved. Those metrics are still useful, but they’re increasingly disconnected from how partners deliver value in a recurring-revenue world. Outcome-based incentives focus instead on the results vendors actually want – customer success, adoption, retention, or ARR growth.

Imagine two MSPs selling the same SaaS platform: one signs ten customers in a month but loses half within a year; the other signs five but retains all of them. Under a traditional program, the first partner wins on volume. Under an outcome-based model, the second partner is rewarded for retention.

We’ve seen vendors experiment with rewarding partners for:

- Driving product usage or adoption rates.

- Maintaining high customer satisfaction (CSAT) or net promoter scores.

- Expanding customer lifetime value through cross-sell or upsell.

- Contributing to co-innovation or solution development.

This approach not only aligns better with subscription economics – it sends a clear message: we value what our customers value.

Of course, there are pitfalls. Measuring outcomes can be messy, especially when data sits across multiple systems or when influence chains are long. But the direction is clear: the market is moving from “rewarding activity” to “rewarding impact.” Remember my analogy about the car race. If you’ve got a minute, have a look at how Red Bull handled this challenge 😊 It worked because there was complete transparency of the rules, and a clear understanding of the strengths and weaknesses of the parties involved.

Designing for Flexibility

The hardest part for most vendors isn’t coming up with new metrics – it’s letting go of old habits. Many channel teams still cling to quarterly spreadsheets and rigid thresholds because they feel tangible. They make reporting easy. But in the process, they often reward predictability over performance.

A flexible engagement model doesn’t mean chaos. It means creating structure around choice. For example:

- Modular MDF programs that allow partners to choose whether to spend on marketing, events, or customer success initiatives.

- Custom enablement tracks where partners can pursue certifications relevant to their role (sales, technical, service) instead of a one-size-fits-all requirement.

- Data-driven partner scoring that updates dynamically based on engagement and results, rather than once a year at program renewal.

Where to Start

If you’re thinking about refreshing your engagement model, start small.

- Audit your incentives – are you rewarding activity or outcomes?

- Segment partners by value type – sellers, influencers, service providers, advisors.

- Pilot flexibility in one area – for example, allow MDF choice or points-based training.

- Collect data on what works and iterate.

But beware, the more flexible a program becomes, the more it depends on trust. When partners believe the rules are transparent and the recognition fair, they’ll support it. When they feel blindsided by opaque metrics or arbitrary rule changes, they’ll pull back.

Closing Thoughts

You can’t have a modern partner program built on yesterday’s logic. The channel has become too diverse, too dynamic, and too data-driven for rigid frameworks to keep up. Vendors that succeed in the next decade will be the ones that recognise engagement not as a policy, but as a partnership.

So if your partner program still looks like a pyramid, it might be time for a refresh. Because as partners evolve, flexibility won’t be a perk – it’ll be table stakes.

Would love to hear what you think. If you’ve got any thoughts or comments, you can contact me HERE.