It may be abhorrent to many vendors, but not all solution providers/MSPs want to grow their business. It may be that they’ve achieved a level of organic growth and profitability they’re happy with, or it may be that the additional investment required may be too great, or it may be a business culture that prefers stability.

Then there’s the hurdle of capability… that is, even if the partner wants to grow, do they know how, and do they have the ability? In particular, during these current times where face-to-face events have become restricted, some partners may not have the know-how to pivot to digital marketing.

Regardless, the challenge for vendors, who have marketing development funds set aside specifically for business development through partners, is deciding which partners to invest in to maximise their return.

Desire to Grow

In last month’s article, Cam Wayland explored the concept of PSYCO – a tool to understand if a partner has the right mix and balance of operating metrics for themselves, or on behalf of a vendor. One particularly telling metric was the “O”… Optimum Volume. This is the point at which a partner can fully utilise their existing resources without incurring new costs. It is the point at which they are most profitable.

The problem is that increasing your volume above the optimum level is a step change, although the revenue increase is gradual. Which means there is a period of reduced cash flow while revenue catches up to the investment. In uncertain times, many partners are not willing to take the risk.

Another factor may be programmatic. I remember speaking to a very successful Cisco partner years ago, and being surprised they were only a Silver Level. When I asked why they weren’t Gold, he explained that the cost for the extra certifications required to achieve Gold meant that he would need to increase his Cisco sales beyond what was appropriate for their model.

It is therefore critical that Channel Account Managers (CAMs) have a deeper understanding of their partner’s business strategy, so that do not invest time in partners who do not have the desire to grow.

Ability to Grow

While the desire to grow is easily determined, the ability to grow is more difficult. Not all partners are willing to divulge their inadequacies, so a CAM may be misled by a partner’s false bravado, only to discover the partner’s limitations at the time of execution.

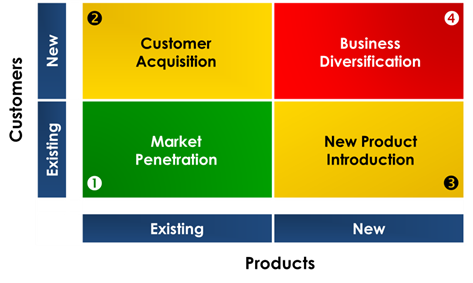

More importantly, we need to be clear on how the partner intends to grow. It may be over 50 years old, but the Ansoff Growth Matrix remains one of the best models to explain business growth. If your partners strategy is largely based on Quadrant 1 (as many partners are) they have probably do not have the growth mindset you are after.

This is further exacerbated by the sudden change our industry has experienced due to restrictions on public gatherings, which have forced companies to adopt more digital strategies. For companies that have relied on face-to-face activities – golf days, events, executive lunches, etc – to create new business, their ability to pivot and adapt will be a determining factor of their success.

Where to Invest

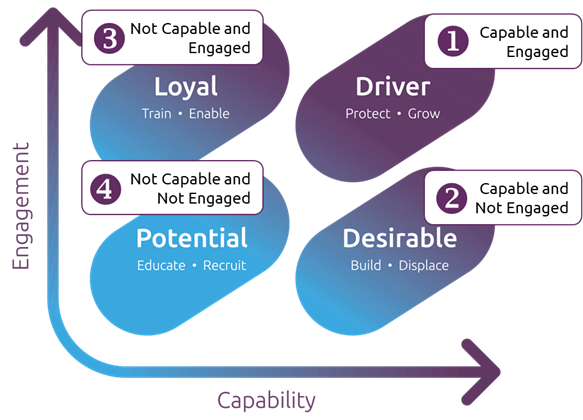

Given that the primary mode of marketing is going to be digital for the foreseeable future, we need to ask two questions:

- What is their digital Capability?

- How Engaged are they with your brand?

We can map this using the following matrix:

Clearly the easy choice are the Drivers – they are capable and engaged. The more difficult choice is the Loyal category. These are partners who are engaged with your product, but do not have the digital marketing capability you need for them to grow your business. Vendors often spend an unproportionate amount of the MDF on these partners because of historical relationships, but are disappointed with the results. Before making a big investment, you need to enable or support those partners to grow. Similarly with Category 3, unless you have an activity plan with clearly defined metrics in place, you may see your funds driving business to the partner, but not necessarily for your products.

How to measure it

While the previous chart may look simple, populating it is a more difficult process if you have several hundred partners.

As such, Channel Dynamics has teamed up with various organisations to automate the process. By analysing a number of different variables – syndicated content, web site tools, data structure and SEO, ad spend, vendor listings, advertising messages, etc – we can accurately map larger groups of partners across these two axes, greatly simplifying the decision-making question of where to invest.

For more info, contact me at mmoses@channeldynamics.com.au